Markets may look chaotic, but patterns exist. One of the most widely used tools for spotting these patterns is Elliott Wave Analysis. For traders working toward a funded trading account with ThinkCapital, learning this method can sharpen your technical skills and help you read price movements with more confidence.

What Is Elliott Wave Theory?

The Elliott Wave Theory, created by Ralph Nelson Elliott, is based on the idea that market prices don’t move randomly. Instead, they follow recurring wave patterns that reflect investor psychology.

- These wave patterns appear in all financial markets: forex, the stock market, and commodity markets.

- The theory is part of classical technical analysis and often used with tools like Fibonacci ratios and momentum indicators.

- Traders use it to forecast market trends, identify turning points, and manage risk more effectively.

Elliott Waves: The Two Core Types

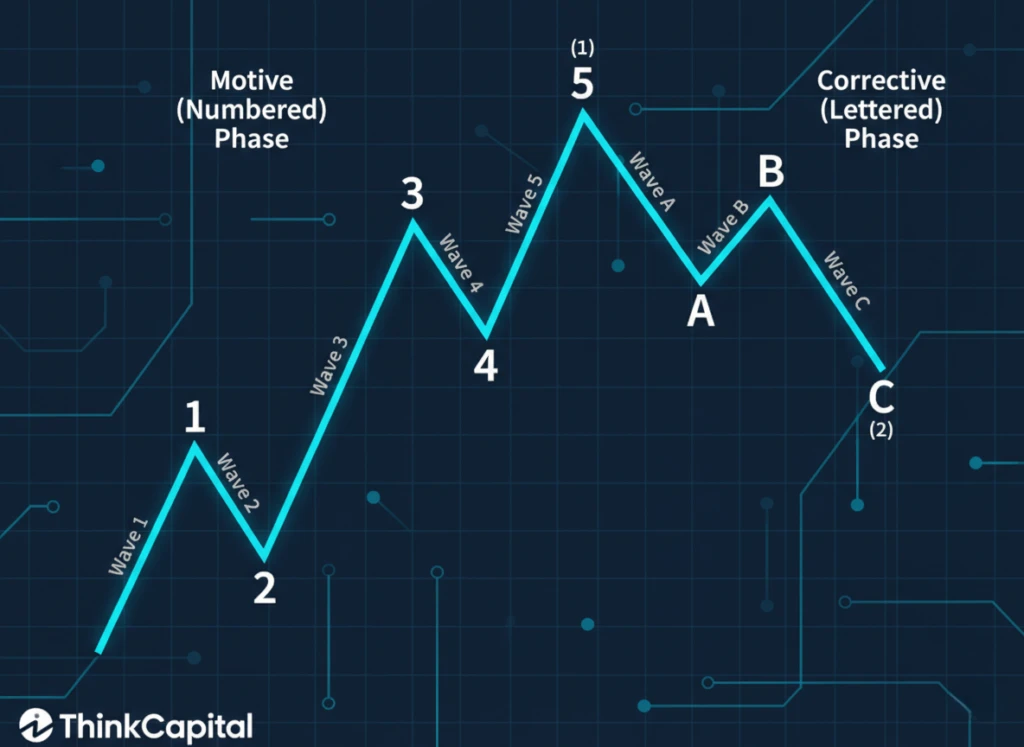

Every Elliott Wave cycle has eight waves: five impulse (motive) waves and three corrective waves. Together, they form the Elliott Wave Principle.

Impulse Waves (Five-Wave Pattern)

Impulse waves move in the direction of the main trend. They’re made up of five sub-waves:

- Wave 1 – Early traders spot opportunity and enter, pushing price higher (or lower in a downtrend).

- Wave 2 – A pullback begins, but it doesn’t erase the gains of Wave 1.

- Wave 3 – The strongest and longest wave. Prices rise quickly as momentum builds, institutional traders enter, and even media coverage adds fuel.

- Wave 4 – A smaller correction. In a standard impulse, it doesn’t overlap Wave 1’s price territory. But in diagonal patterns (waves 1, A, 5, or C), overlap is allowed. The only strict rule is that overlap cannot occur when the structure is part of Wave 3.

- Wave 5 – The final push. Many average investors finally buy in, often driven by fear of missing out.

This structure explains why markets often peak just as more people feel “safe” to enter.

Corrective Waves (Three-Wave Pattern)

Corrective waves move against the trend. They usually come in three parts, labeled A–B–C:

- Wave A – The first counter-trend move. Some see it as just a pullback.

- Wave B – A bounce that feels like the trend is resuming, but confidence is shaky.

- Wave C – The final leg down (or up in a bear market correction), often the sharpest move of the three.

Corrective waves help the market “reset” before the next larger trend begins.

Using Fibonacci Ratios with Elliott Wave Analysis

Fibonacci ratios give Elliott Wave analysis more precision. Traders use retracements and extensions to measure wave lengths and forecast price targets.

- Common retracement levels: 38.2%, 50%, 61.8%

- Wave 2 often retraces 50–61.8% of Wave 1

- Wave 3 often extends to 161.8% of Wave 1

- Support and resistance levels often align with Fibonacci zones

These ratios turn wave counts into actionable trading setups by highlighting likely price territory for reversals.

How Traders Apply Elliott Wave Patterns

Here’s a practical workflow for traders:

- Identify the current wave count on your chart.

- Check the motive or corrective character to confirm if you’re trading with or against the trend.

- Use Fibonacci levels to project retracements and extensions.

- Combine with momentum indicators (like RSI or MACD) for confirmation.

- Keep the larger trend in mind to avoid chasing short-lived counter moves.

Common Mistakes to Avoid

- Forcing a count: Not every move fits neatly into an Elliott Wave pattern.

- Ignoring context: In a standard impulse, Wave 4 shouldn’t overlap Wave 1. But diagonals are exceptions where overlap is valid. The one place overlap is never allowed is inside Wave 3.

- Overlooking context: Wave analysis works best when paired with other forms of comprehensive analysis.

- Overcomplicating corrections: Some corrective waves subdivide, but simplicity often works best.

FAQs on Elliott Wave Analysis

Q: What is an Elliott Wave forecast?

A: It’s a projection of where the market may go next, based on the current wave structure. Traders use it to prepare for both trend continuation and corrections.

Q: What’s the difference between impulse and corrective waves?

A: Impulse waves have five parts and move with the main trend. Corrective waves have three parts and move against the trend.

Q: How do I know if I’ve identified waves correctly?

A: Follow key rules: Wave 3 can’t be the shortest of 1, 3, 5, and Wave 4 shouldn’t overlap Wave 1’s price territory.

Q: Can Elliott Waves be used in forex?

A: Yes. They work across financial markets: forex, stocks, and commodities. Many forex traders rely on wave structures to anticipate shifts in momentum.

Q: Are Elliott Waves always accurate?

A: Not always. They’re subjective, so two traders might label waves differently. But when combined with Fibonacci and momentum indicators, they provide a strong trading framework.

Conclusion

Elliott Wave Analysis gives structure to what often looks like random price action. It helps traders see the bigger picture and prepare for both bull markets and bear markets.

If you’re serious about trading and aiming for a funded account, understanding Elliott wave patterns can give you an edge. Combine it with support and resistance levels, Fibonacci ratios, and momentum indicators, and you’ll make better-informed decisions.

Want to put your skills into practice? Explore ThinkCapital’s trading programs and start building toward your next funded account.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Elliott Wave Analysis is a form of technical analysis that carries significant risk, and past performance is not a guarantee of future results. Trading in forex, stocks, or commodities can lead to losses greater than your initial investment.

Before trading, carefully consider your financial situation, experience, and risk tolerance, and seek advice from a qualified professional if needed. The information provided here is a general overview of Elliott Wave Theory and not a complete guide. References to ThinkCapital are for illustration only and do not represent an endorsement. All examples are for educational use.